Auto Loan: Loan EMI Calculator

All trademarks belong to their respective owners.

| Update : 2024-09-30 | Developer : Campingg Studio |

| OS : IOS/ Android | Category : App |

Advestisment

Auto Loans The Auto Loan: Loan EMI Calculator app is a powerful tool developed by Campingg Studio that helps users easily and accurately calculate monthly payments for auto loans. With its user-friendly interface and smart features, the app has attracted over 50M users worldwide. Whether you're a first-time car buyer or a financial professional, this app will assist you in managing your loan effectively.

Loan Calculator and Finance: A Detailed Guide on How to Use and Calculate Loans

In the modern financial world, using a Loan Calculator has become a crucial tool to help people easily estimate borrowing costs. Are you looking to expand your business and need to know the cost of a loan? Do you want to own your dream car or house and are wondering about the monthly payments? All these questions can be answered using a Loan Calculator or other financial tools. In this article, we will explore in detail how the Loan EMI Calculator works and the benefits it brings to the field of finance.

Advertisement

What is a Loan Calculator?

A Loan Calculator is an online tool or app that helps you calculate the Equated Monthly Installment (EMI) when borrowing money. This tool usually allows users to input the loan amount, interest rate, and loan term to get accurate results regarding monthly payments and the total interest cost over the life of the loan.

Why is a Loan Calculator Important in Finance?

Using a Loan Calculator helps borrowers gain a clear view of their payment obligations, enabling them to make more informed financial decisions. In the realm of finance, understanding the cost of borrowing can help you:

- Accurately estimate costs: Knowing your monthly payment in advance helps you plan your finances in detail and create a backup strategy if needed.

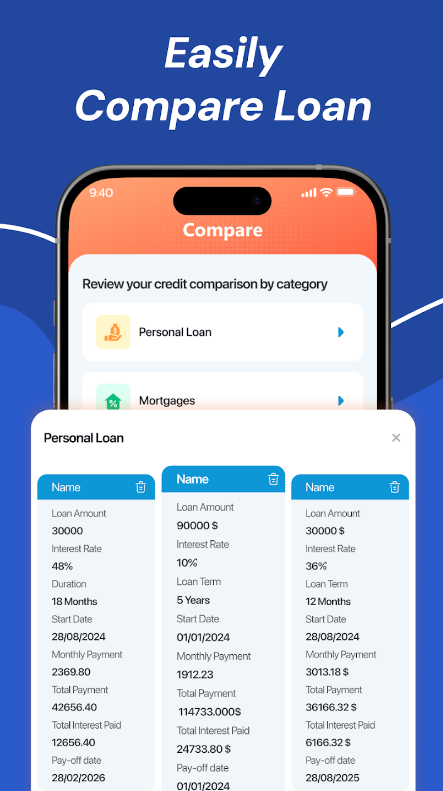

- Compare loans: Easily compare different loans based on interest rates, loan terms, and overall costs.

- Minimize financial risks: Calculating in advance helps you avoid taking on loans that exceed your ability to repay, reducing financial risk.

Popular Types of Loan Calculators

1. Auto Loan Calculator

The Auto Loan Calculator is an excellent tool for those looking to purchase a car. It helps you calculate monthly payments based on the loan amount, interest rate, and loan term. You only need to enter the basic details like:

- Loan amount: The total value of the car you intend to buy.

- Interest rate: The rate at which you will be charged for the loan.

- Loan term: The duration over which you will repay the loan.

Using the Auto Loan Calculator enables you to plan your finances clearly and avoid unexpected costs.

2. Mortgage Loan Calculator

If you’re looking to buy a house, the Mortgage Loan Calculator will be a reliable companion. This tool helps you easily calculate your monthly mortgage payments by entering details such as:

- Principal amount: The amount you need to borrow to buy a house.

- Down payment: The amount you have already paid upfront.

- Interest rate and loan term: These factors directly influence your monthly payments and total interest cost.

The Mortgage Loan Calculator allows you to compare different loan scenarios to find the best solution that fits your budget.

3. Business Loan Calculator

For businesses planning to expand, the Business Loan Calculator is a vital tool. It assists companies in accurately calculating borrowing costs. Simply input details such as:

- Loan amount: The capital you need for business growth.

- Annual interest rate: The interest rate applied to your business loan.

- Loan term: The period over which your business plans to repay the loan.

4. Personal Loan Calculator

The Personal Loan Calculator helps you calculate monthly payments for personal loans. This tool is useful when you need a loan for personal needs such as travel, shopping, or paying off minor debts. You can use this calculator to estimate costs and manage your personal finances effectively.

Benefits of Using a Loan Calculator in Finance

Using a Loan Calculator not only helps you calculate loan payments but also plays a crucial role in financial decision-making. Here are some of the main benefits:

- Time-saving: You don’t have to manually calculate complex numbers, and you can still get accurate results within seconds.

- Minimizes errors: Calculation mistakes can lead to wrong decisions. The Loan Calculator helps you minimize these risks significantly.

- Easy parameter adjustments: You can easily adjust the loan amount, interest rate, or term to see different financial scenarios.

Additional Financial Tools in the Loan Calculator

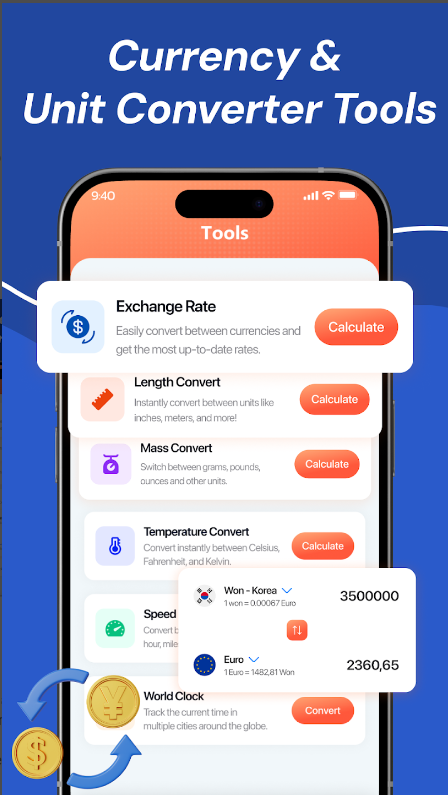

Besides loan calculation features, the Loan Calculator also includes several other financial tools, such as:

- Exchange rate calculator: Helps you quickly and accurately convert different currencies.

- Unit converter: Supports converting common units like length, mass, temperature, time, etc.

Important Notes When Using a Loan Calculator

While a Loan Calculator is a useful tool for loan calculations, there are a few things to keep in mind:

- Results are for reference only: The figures provided by the Loan Calculator are estimates and not official commitments from banks or financial institutions.

- Understand loan terms: It’s advisable to consult with financial experts or bank advisors for the best decision-making process.

Conclusion

The Loan Calculator is a powerful tool that allows you to easily calculate loans in various areas such as home purchases, car purchases, business expansion, and personal financial needs. Understanding how to use the Loan Calculator will help you make sound financial decisions and optimize your budget. In the field of finance, understanding costs and interest rates is crucial for effective financial control and ensuring long-term stability.